- CREDIT SCORE RANGE HOW TO

- CREDIT SCORE RANGE FULL

- CREDIT SCORE RANGE SOFTWARE

- CREDIT SCORE RANGE FREE

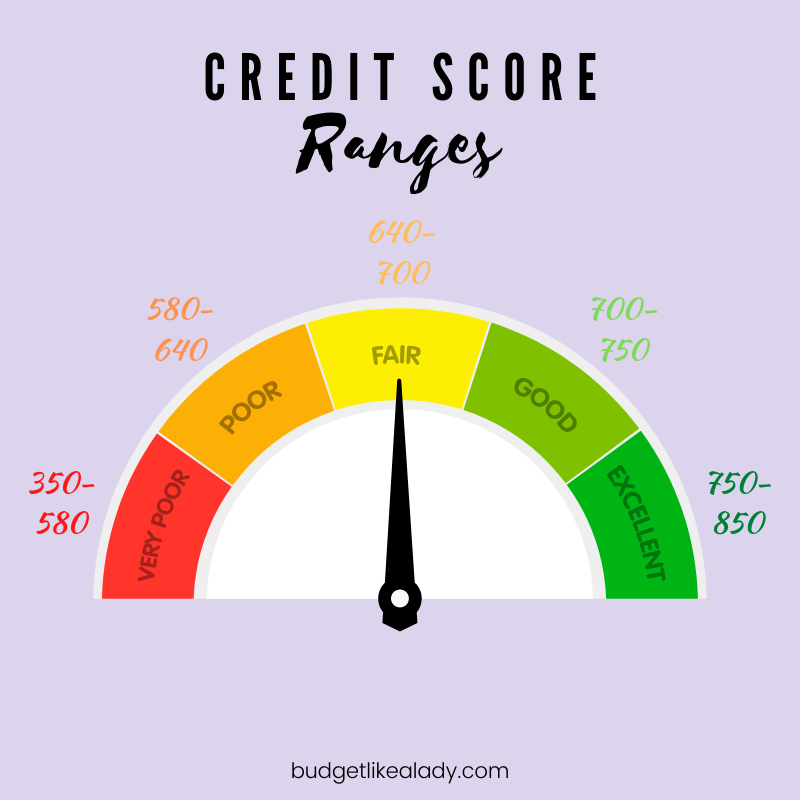

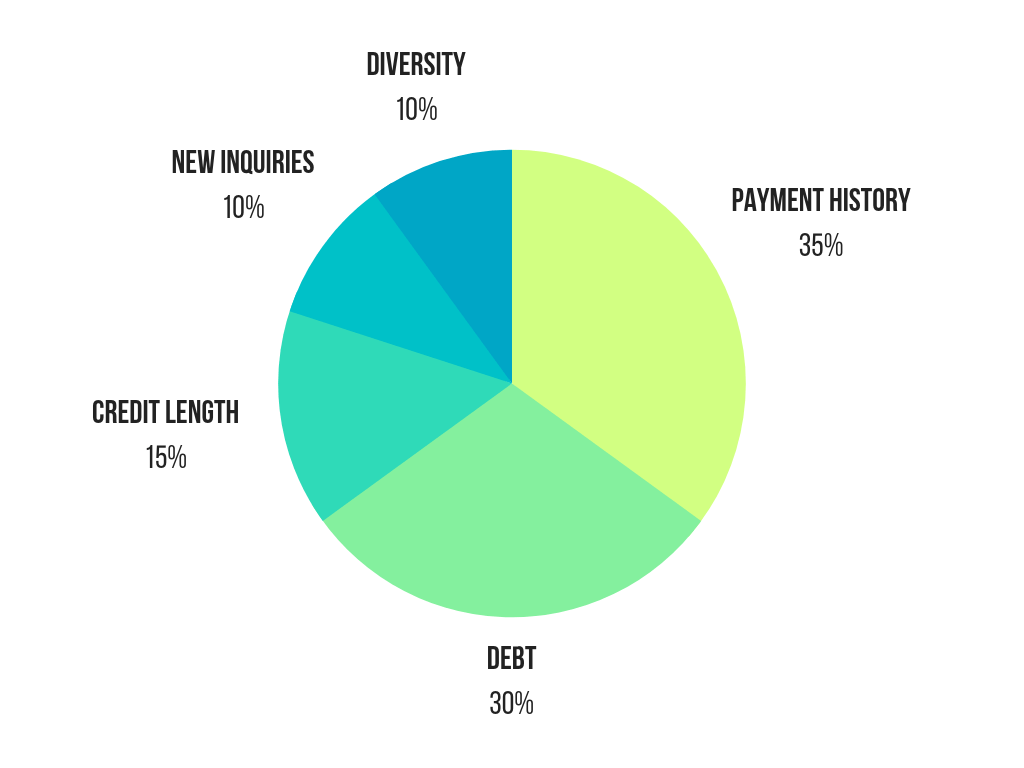

Credit mix makes up only 10% of your score and, in the run of a long life, good financial habits are likely more important than hitting 850. And it’s not wise to avoid paying down debt just to keep the variety. But it doesn’t make sense, of course, to take on new loans if you can’t pay them back. Credit score companies like to see a wide variety of credit sources, like multiple loans and credit cards. Your payment history makes up 35% of your FICO score.

Always pay on time and never miss a payment. Instead of paying your statement once a month, some 800 club members make credit card payments weekly to avoid carrying a balance. Try to limit applications and shop around with prequalification tools that don't hurt your credit score.Still, if a perfect credit score is your goal, you may want to consider these expert credit tips compiled from credit score perfectionists: Inquiries temporarily reduce your credit score about five points, though they bounce back within a few months. Each time you apply for credit, whether it's a credit card or loan, and regardless if you're denied or approved, an inquiry appears on your credit report. (Utilization rate, a calculation of how much of your total credit limit you're using, can be found with a simple equation: your total credit card balance divided by your total credit limit).

CREDIT SCORE RANGE FULL

While you should always make at least your minimum payment, we recommend paying your bill in full every month to reduce your utilization rate. Autopay is a great way to ensure on-time payments, or you can set up reminders in your calendar.

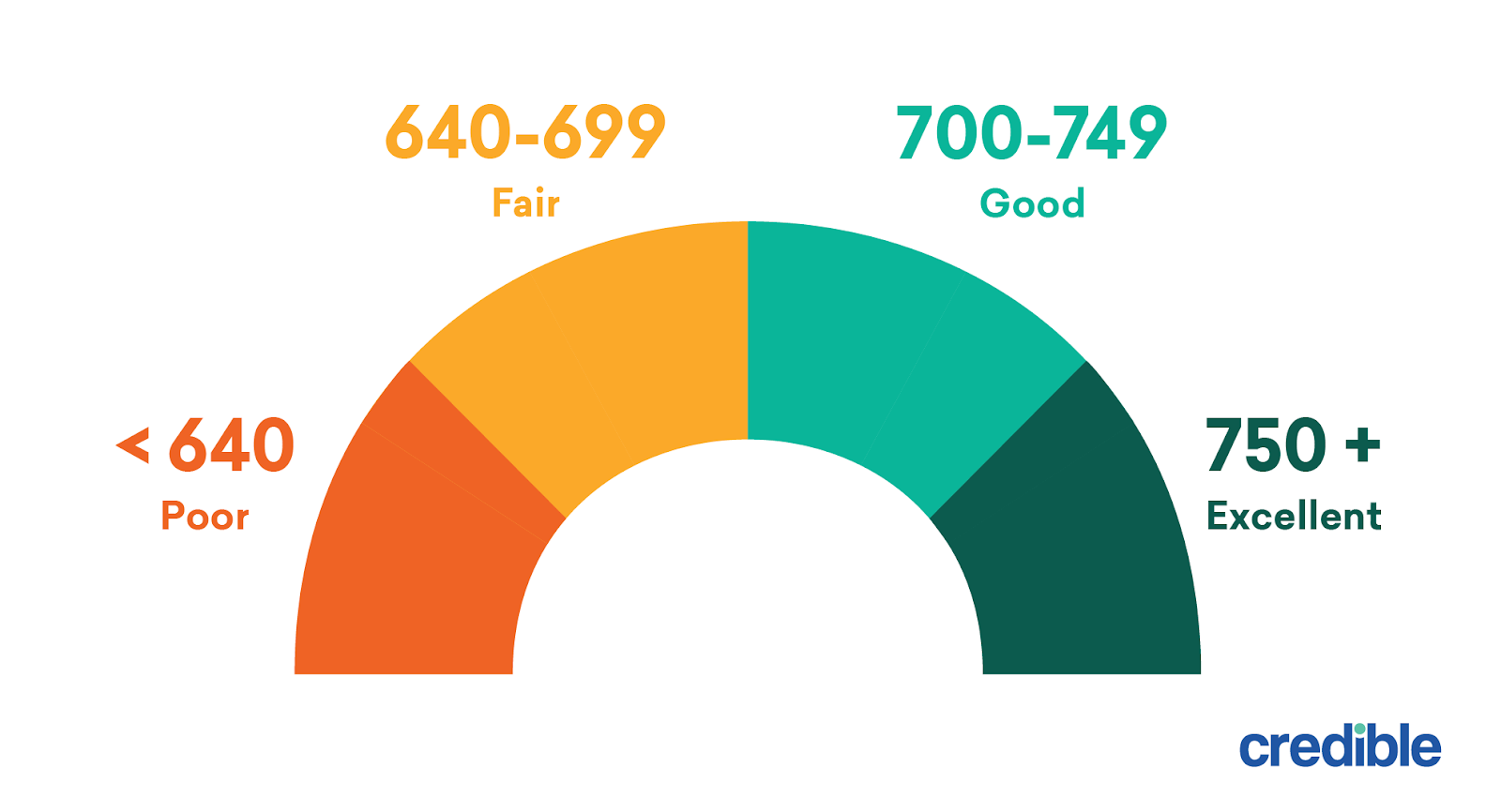

Payment history is the most important factor in your credit score, so it's key to always pay on time. If your credit score falls within the good, fair or bad ranges and you want to get an excellent credit score, follow these tips to help raise your credit score. Card issuers look at more factors than just your credit score, including income and monthly housing payments.

Take note that even if your credit score falls within the excellent range, it's not a guarantee you'll be approved for a credit card requiring excellent credit. Terms apply.Īnd if you want to finance new purchases or get out of debt with a balance transfer card, such as the Chase Freedom Unlimited®, you'll also need good or excellent credit. supermarkets (on up to $25,000 per year in purchases, then 1X) - but you'll need good or excellent credit. And if you have an excellent credit score, you can maximize approval odds.įor instance, if you're looking to earn generous rewards on groceries and dining out, the American Express® Gold Card offers cardholders the chance to earn 4X Membership Rewards® points when you dine at restaurants and shop at U.S. If you want to benefit from competitive rewards, annual statement credits, luxury travel perks, 0% APR periods and more, you'll need at least a good credit score. Many of the best cards require good or excellent credit.

CREDIT SCORE RANGE FREE

Investing +More All Investing Best IRA Accounts Best Roth IRA Accounts Best Investing Apps Best Free Stock Trading Platforms Best Robo-Advisors Index Funds Mutual Funds ETFs BondsĪn excellent credit score can help you receive the best APRs from lenders and give you a higher chance of being approved for credit cards and loans.

CREDIT SCORE RANGE HOW TO

Help for Low Credit Scores +More All Help for Low Credit Scores Best Credit Cards for Bad Credit Best Personal Loans for Bad Credit Best Debt Consolidation Loans for Bad Credit Personal Loans if You Don't Have Credit Best Credit Cards for Building Credit Personal Loans for 580 Credit Score Lower Personal Loans for 670 Credit Score or Lower Best Mortgages for Bad Credit Best Hardship Loans How to Boost Your Credit Score

CREDIT SCORE RANGE SOFTWARE

Taxes +More All Taxes Best Tax Software Best Tax Software for Small Businesses Tax Refunds Small Business +More All Small Business Best Small Business Savings Accounts Best Small Business Checking Accounts Best Credit Cards for Small Business Best Small Business Loans Best Tax Software for Small Business Personal Finance +More All Personal Finance Best Budgeting Apps Best Expense Tracker Apps Best Money Transfer Apps Best Resale Apps and Sites Buy Now Pay Later (BNPL) Apps Best Debt Relief Best Mortgages for Average Credit Score.Best Loans to Refinance Credit Card Debt.

0 kommentar(er)

0 kommentar(er)